child tax credit september 2021 deposit date

2021 Child Tax Credit and Advance Payments. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Child Tax Credit 2021 How To Track September Next Payment Marca

The IRS sent six monthly child tax credit payments in 2021.

. The IRS plans to issue direct deposits on the 15th of each month. Some parents are missing their September child tax credit payments. This is the only month where parents get the advance child tax credits early with the rest to be paid on September 15 October 15 November 15 and December 15.

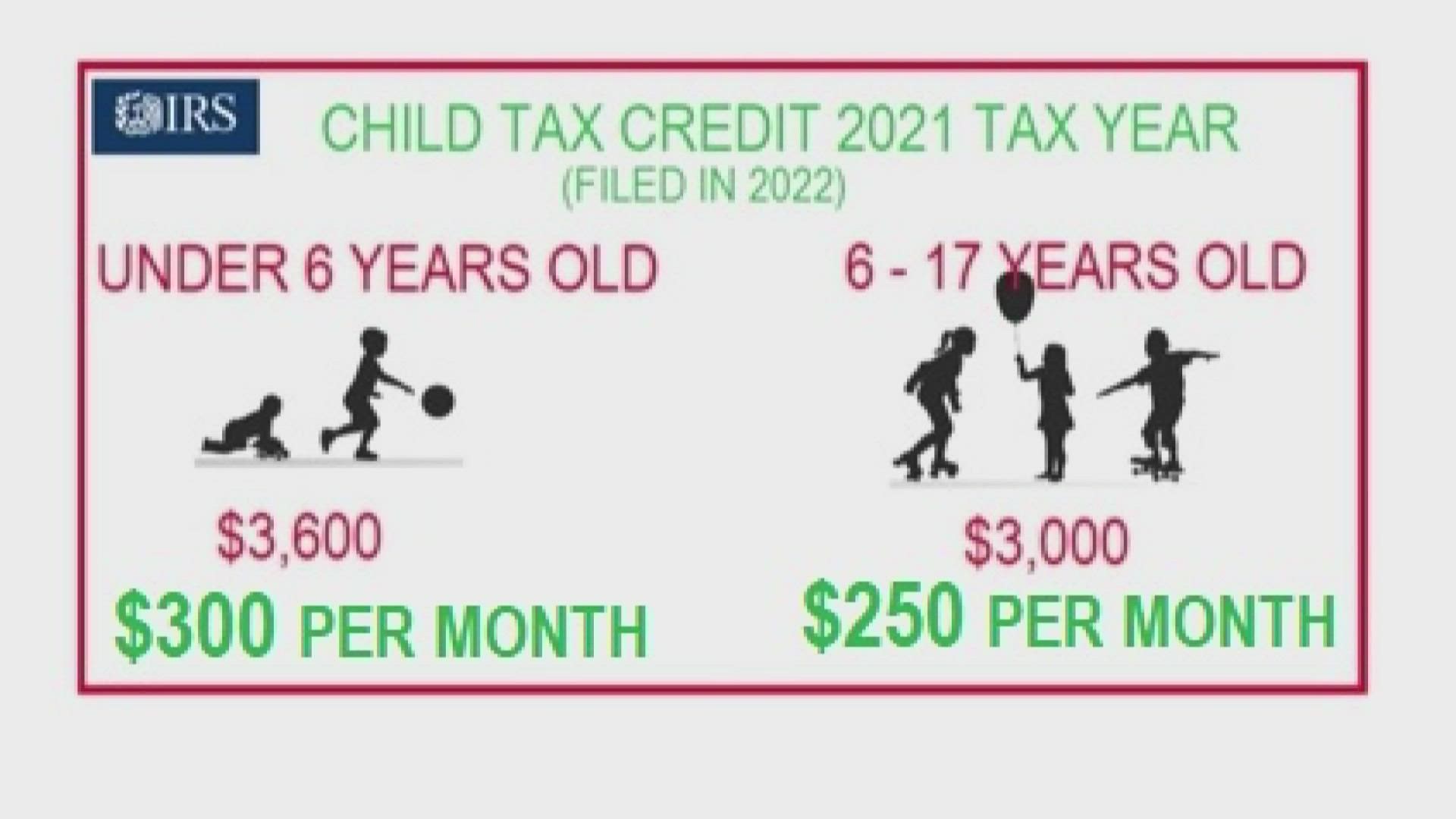

Child tax credit september 2021 payment date. The remaining 2021 child tax credit payments will be released on Friday October 15 Monday November 15 and Wednesday December 15. The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6 to 17 years old.

November 25 2022 Havent received your payment. IR-2021-143 June 30 2021. The second payment was sent out to families on August 13.

Here are further details on these payments. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. Missing September Child Tax Credit.

Wait 10 working days from the payment date to contact us. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. The American Rescue Plan Act ARPA increased the 2021 child tax credit from 2000 to 3600 for children under age 6.

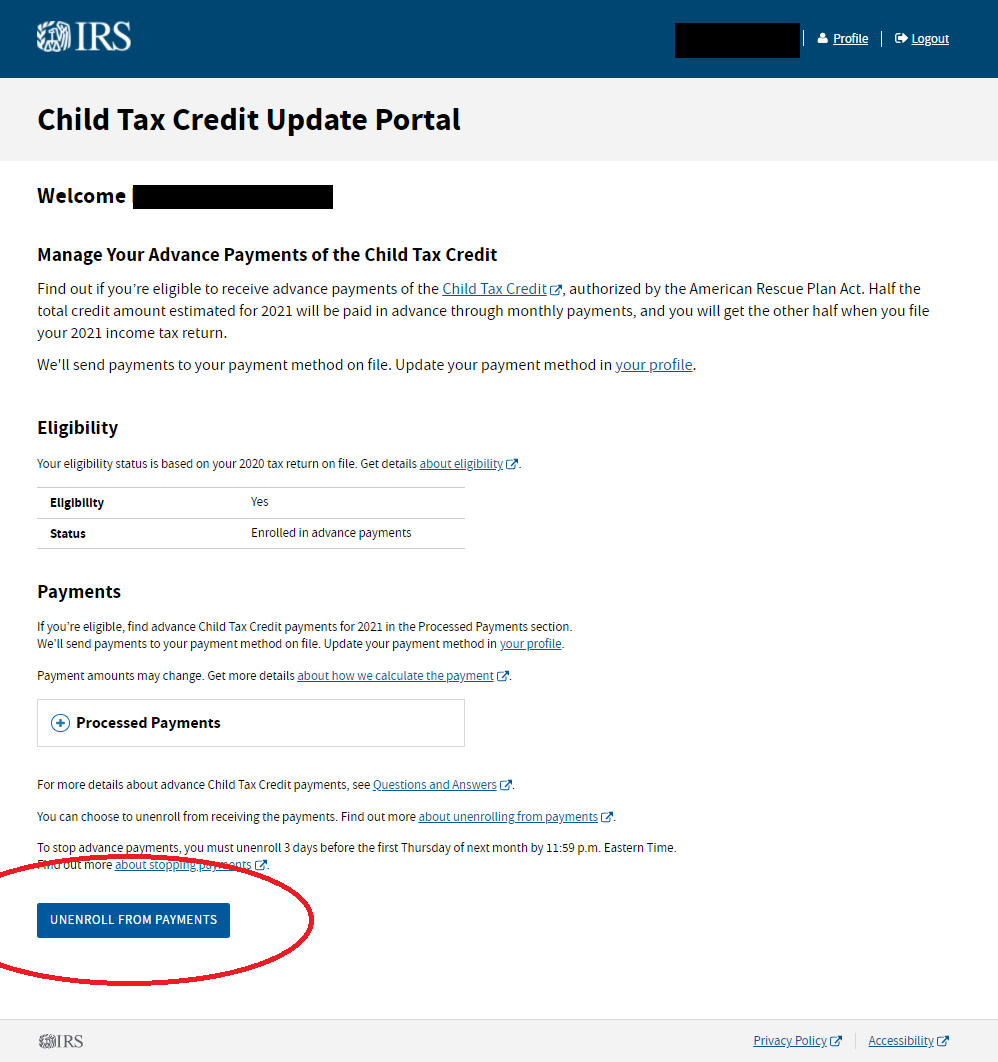

Instead of calling it may be faster to check the. By August 2 for the August. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov.

Answers to all your questions about the 2021 Child Tax Credit including how much the Child Tax Credit is when it will be paid and whether your family will qualify for payments. If youve received a child tax credit payment in July and August and you have not opted out you will receive your September payment as. 15 opt out by Aug.

Will they send any more in 2022. Next months payments are then scheduled for October 15. The deadline to opt out for September has just passed but there are still future opportunities for.

13 opt out by Aug. Typically the IRS starts sending out checks to qualifying families on the 15th of each month. Ad Free tax support and direct deposit.

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. Child tax credit september 2021 payment date. Alberta child and family benefit ACFB All payment dates.

Child tax credit. Even though child tax credit payments are scheduled to arrive on. Taking into account the last half of the Child Tax Credit payment which will arrive in 2022 those eligible households will receive a total.

The rest will be paid with a tax refund in 2022. Qualifying American families will receive up to 3600 per child for the tax year 2021. Benefit and credit payment dates.

So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per. Related services and information. 29 What happens with the child tax credit payments after December.

For these families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. When does the Child Tax Credit arrive in September. 15 some families are getting anxious that they have yet to receive the money according to a.

Wait 5 working days from the payment date to contact us. WASHINGTON The Internal Revenue Service today upgraded a key online tool to enable families to quickly and easily update their bank account information so they can receive their monthly Child Tax Credit payment. The child tax credit for September 2021 is also late due to an IRS delay.

The next payment is October 15 and it could be one of the last. 1017 ET Sep 15 2021. Updated September 21 2021 738 AM.

Here are the official dates. 15 opt out by Oct. Instead you will receive one lump sum payment with your July payment.

Any updates made by August 2 will apply to the August 13 payment and all subsequent monthly payments for the rest of 2021. Child Tax Credit 2021. Families will see the direct deposit payments in their accounts starting today September 15.

When is deadline to opt out from the September payment. Some parents may not want to get the monthly payments particularly if their incomes increase this yearThe payments are credits toward families tax liability for 2021 but are based on 2020 or. More information on the Child Tax Credit payments can be found.

The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6 to 17 years old. The payments will be made either by direct deposit or by paper. More than five days since the deposit date and the bank says it hasnt received.

Child Tax Credit. 15 opt out by Nov. The Child Tax Credit is tied.

15 opt out by Nov. Like the prior payments the vast majority of families will receive them by direct. Message designed for taxpayers claiming the child tax credit or earned income tax credit.

However given that August 15 falls on a Sunday in 2021 eligible families will get the cash two days early on August 13 instead. You will not receive a monthly payment if your total benefit amount for the year is less than 240. The third payment date is Wednesday September 15 with the IRS sending most of the checks via direct deposit.

The couple would then receive the 3300 balance 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child as part of their 2021 tax refund.

Irs Child Tax Credit 2021 Update Advance Payment Date For November Revealed And Opt Out Deadline You Must Act Before

When Parents Can Expect Their Next Child Tax Credit Payment

Childctc The Child Tax Credit The White House

Child Tax Credit 2021 Here S When The Third Check Will Deposit Cbs News

The Big Increase And More Changes To The Child Tax Credit In 2021

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credits When Is The October Payment And What Is The Deadline To Unenroll From Monthly Payments

Health Insurance Sec 80d Tax Deduction Fy 2020 21 Ay 2021 22 Income Tax Tax Deductions Tax Forms

Health Insurance Sec 80d Tax Deduction Fy 2020 21 Ay 2021 22 Income Tax Tax Deductions Tax Forms

2021 Child Tax Credit Payments Does Your Family Qualify

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit Did Not Come Today Issue Delaying Some Payments 10tv Com

Deadline To Opt Out Of September Child Tax Credit Payment Is Monday Here S How To Cancel It Fingerlakes1 Com

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit 2021 8 Things You Need To Know District Capital

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back