san antonio property tax rate 2021

2019 to 2020 fiscal year property tax rates. The 2021 rate of 276237 cents per valuation is mostly unchanged from 2020s rate of 277429 cents per 100 valuation.

Find Your Next Home Berkshire Hathaway Homeservices Real Estate Information Credit Reporting Agencies Mortgage Payment

It shaves 001.

. The San Antonio sales tax rate is. We calculate taxes by multiplying appraisal values by tax rates. The property tax rate for the City of San Antonio consists of two components.

This is the total of state county and city sales tax rates. San Antonio citiestowns property tax rates. A tax lien is automatically attached to all taxable properties on January 1 of each year to secure the tax liability.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. For 2021 at their meeting on october 26 2021 the alamo colleges districts board of trustees approved the proposed property tax rate. 6 for the first month.

0250 San Antonio ATD Advanced Transportation District. 1000 City of San Antonio. The Texas sales tax rate is currently.

What is San Antonio property tax. What is the sales tax rate in San Antonio Texas. King County collects the highest property tax in Texas levying an average of 506600 156 of median home value yearly in property taxes while Terrell County has the lowest property tax in the state collecting an average tax of 28500 067 of median home.

But the countys financial backbone during the pandemic has been property taxes. Tax amount varies by county. San antonio citiestowns property tax rates the following table provides 2017 the most common total combined property tax rates for 46 san antonio area cities and towns.

In San Antonio the countys largest city and the second-largest city in the entire state the tax rate is 261. This city can afford to give more back to our homeowners in this town through a property homestead exemption Perry said noting that the city saw an increase of 20 million in property taxes from 2020 to 2021. And an additional 2 for the sixth month for a total of 12.

The average homeowner in Bexar County pays 2996 annually in property taxes on a median home value of 152400. In addition to interest delinquent taxes incur the following penalties. The minimum combined 2022 sales tax rate for San Antonio Texas is.

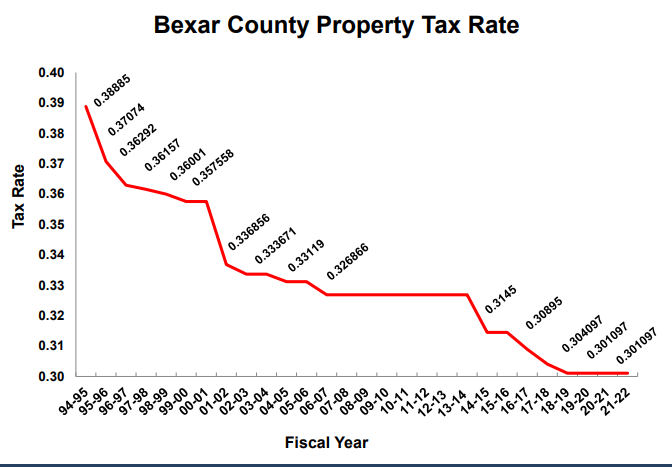

Commissioners voted 3-1 with one abstention to cut the tax rate for the countys portion of property tax bills from 0301097 to 0299999 for every 100 of valuation. 0125 dedicated to the City of San Antonio Ready to Work Program. SAN ANTONIO In just the past four years Elsie Guzman has seen the value of her modest Denver Heights home more than double.

The tax rate varies from year to year depending on the countys needs. 0500 San Antonio MTA Metropolitan Transit Authority. During the course of the year there are several phases involved in the taxation process.

The following table provides 2017 the most common total combined property tax rates for 46 San Antonio area cities and towns. Ad Find Out the Market Value of Any Property and Past Sale Prices. At a total rate of 242 per hundred dollars a home in Windcrest valued at the San Antonio average home price of 240000 would pay 580775- 64343 a year less than a homeowner paying San Antonio property taxes would pay if they.

An additional 1 for each of the following 4 months. 0125 dedicated to the city of san antonio ready to work program. The County adopted a budget that eliminates 19 deputy constable positions.

Scroll to see the property features tax value mortgage calculator nearby schools and similar homes for sale. During these phases appraisal districts identify and appraise all real and business personal. You can use the Texas property tax map to the left to compare Bexar Countys property tax to other counties in Texas.

San Antonios current sales tax rate is 8250 and is distributed as follows. 48 rows TOTAL TAX MUNICIPAL TAX SCHOOL TAX COUNTY TAX SCHOOL DISTRICT COUNTY-----Alamo Heights. My husband is 100 disabled so our taxes dont go up as much.

Road and Flood Control Fund. Dadgummit we can afford this San Antonio implemented its first homestead exemption the minimum allowed by the state in 2020. The Commissioners Court also voted Tuesday to.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. The san antonio sales tax rate is. A Bexar County deputy constable watches Tuesdays Commissioners Court meeting.

For property tax purposes January 1 of each year is the effective date of the tax roll. 39 rows Tax Rate 100 Homestead 65 and Older Disabled Freeze Year. Scott Ball San Antonio Report.

The County sales tax rate is. China Grove which has a combined total rate of 172 percent has the lowest property tax rate in the San Antonio area and Poteet with a combined total rate of 322 percent has the highest rate in the area. The local property tax base rose by 9 billion to 1916.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling. Bexar County commissioners approved a 178 billion budget for the 2020-2021 fiscal year on Tuesday. Did South Dakota v.

For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. A delinquent tax incurs interest at the rate of 1 for the first month and an additional 1 for each month the tax remains delinquent. 0 River Rock Rd currently not for sale is located in Bexar County.

In 2019 the median property value in san antonio tx was 171100 and the homeownership rate was 535. The property information herein and below is from the county appraisal district and should be independently verified. Paying eight different types of property taxes the total bill still comes out lower than homes paying San Antonio property taxes.

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Bexar County Commissioners Approve Symbolic Property Tax Cut

Ranking Of Best Places To Buy A House Based On Home Values Property Taxes Home Ownership Rates And Real Home Ownership Houses In America Real Estate Trends

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

Why Are Texas Property Taxes So High Home Tax Solutions

Pin On General Real Estate Information

4 Ways To Be Ready For A Bidding War In 2021 Real Estate Video Selling House War

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

2021 Real Estate Market Real Estate Infographic Real Estate Marketing Marketing

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Irs Stands Firm On July 15 Tax Deadline For 2019 Returns Tax Deadline Irs Income Tax Return

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Salah Smm I Will Be Your Professional Social Media Manager For 80 On Fiverr Com In 2021 Log Cabin Cabin Vacation Home